Next – Voices from the Future | Speeding up services, streamlining processes, enhancing user experience: what are fintech and insurtech today, and what will they become?

There’s an English word that entered our vocabulary years ago and has become a mantra because it defines our positioning, our business, and the work of our people. Actually, it goes even further. In Italy, we were pioneers in adopting it, identifying open finance and an open ecosystem as distinctive elements. I’m talking about fintech. And with this year-end episode, in this format that highlights voices from the future - words that best represent innovation - we can’t help but delve into it in detail. Fintech, as we said. In its broadest sense, it refers to any application of technologies and digital innovations in finance. As smartphones have become embedded in more and more areas of our lives, many industries have felt the pressure to increasingly digitalize their functionalities and services. Fintech is just another example of a sector - the financial one, where we operate - that has steadily entered the digital era.

Fintech products and services offer many tangible benefits to both consumers and businesses. For consumers, fintech has brought innovations in digital payments and new ways to manage and optimize personal finances. On the business side, fintech helps automate and streamline processes, speeding up the delivery of new digital products to customers. Here’s a look at the three main advantages for each audience, starting with consumers. According to an IBM analysis, there are three key benefits for external customers:

- Improved business processes: Fintech capabilities have simplified business processes by automating routine tasks associated with banking services. Companies managing fintech applications have seen their transaction and investment processes significantly accelerate with mobile apps.

- Reduced time-to-market for new products: launching new services and features in response to customer demand is much easier for financial institutions that have invested in fintech.

- Better customer retention: companies that use fintech intelligently can provide customers with a highly personalized and enjoyable digital experience, boosting retention and, inevitably, satisfaction.

In Italy, the fintech sector and its insurance counterpart, insurtech, are undergoing a period of profound transformation and consolidation, in line with global trends. Amid a macroeconomic environment marked by rising interest rates aimed at curbing inflation, innovative startups are playing a crucial role in accelerating the digital evolution of financial and insurance services.

A closer look at the Italian market reveals that, as of last year, the ecosystem comprised 622 fintech and insurtech startups, 109 of which operate in the insurance sector. Of these, 305 are part of the Fintech District community, a hub for Italian innovation, with 30% of its members being international companies. The sector's diversity is broad, with a growing focus on TechFin (81 companies), Payments (46), and emerging segments like Regtech, WealthTech, and Crypto & DeFi.

However, an 81% drop in funding compared to 2022 (€174 million less raised) reflects a global trend of increased caution among venture capitalists. Despite this, successful startups such as Satispay (in fintech) and Yolo (in insurtech) have shown that growth is possible even in challenging economic conditions, thanks to solid business models and strategic partnerships. Collaboration is essential for startup success, with 82% of Italian companies working with at least one strategic partner, and 33% receiving direct investments from collaborators. Open innovation has proven to be a winning strategy, exemplified by our Group’s initiatives with Open Innovation Centers, Sellalab, and the Open Innovation team.

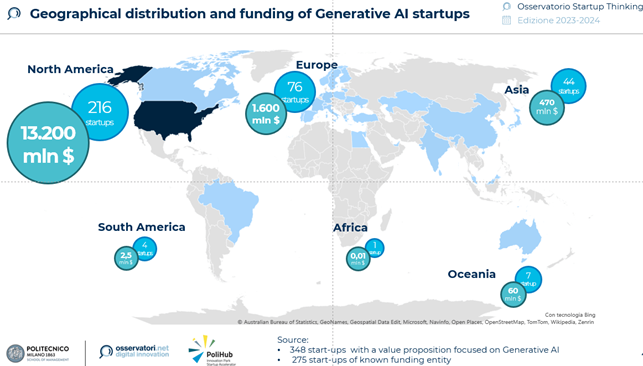

Let’s move on to investments. 46% of startups are seeking VC support through opening funding rounds in the coming months. Certainly, the pursuit of funding demonstrates the startups’ full capacity to plan their future effectively, but it also highlights a short-term challenge in achieving sustainable models. A comparison with foreign markets shows that U.S. and European markets, while following similar trends, exhibit different approaches to funding. In the United States, funding rounds are often larger, and startups scale faster thanks to a more established venture capital ecosystem. Companies like Stripe and Plaid have attracted billions of dollars in investments with their innovative solutions for payments and open banking. In Europe, countries like the United Kingdom and Germany stand out for their more mature markets. London, in particular, remains the nerve center of European fintech, with startups like Revolut redefining the concept of digital banking. Italy, however, still struggles with internationalization: only 41% of Italian startups operate abroad, compared to a European average exceeding 50%. The fintech ecosystem is also looking to new trends, particularly generative intelligence. In fact, 19% of Italian fintech companies are exploring applications of generative AI to personalize financial services, optimize customer service, or improve underwriting processes.

In conclusion, the future of fintech and insurtech in Italy hinges on the ability to integrate open innovation with a long-term strategic vision. Collaborations between startups, large corporations, and investors can accelerate the adoption of groundbreaking technologies and promote greater internationalization. In an increasingly digital and interconnected world, Italy has the opportunity to become a hub for innovative financial solutions. However, achieving this goal requires a collective effort: increased investments, favorable regulations, and support from initiatives such as those offered by the Fintech District. By leveraging these drivers, the country can bridge the gap with more advanced markets and turn challenges into opportunities for sustainable growth.