That balancing act between transparency, security and privacy - the finance of the future under the RegTech banner

We live in a world racing ahead at increasing speed compared to the past, which often prevents us from understanding and decoding new phenomena. A world that is both connected and interconnected, in which actions may result in unforeseeable reactions. This is nothing new - as early as the 1970s, US mathematician and meteorologist Edward Norton Lorenz theorized how the flap of a butterfly's wings in Brazil might cause a tornado in Texas. Today, fifty years later, sudden changes in a constantly evolving scenario are accelerated by the power of the web and the seamless connection of chat rooms and social media networks.

Yet we need to capture, to take a snapshot of, what is happening - albeit a blurry one because it is in motion – in order to slow down and reflect on the emerging international trends that are rewriting products, services, visions, and relationships.

This is what our new Insights feature is all about - a longform with in-depth content. Through monthly issues we will bring you insightful stories on a number of pivotal topics, a way to understand what is happening around us and to get a sense of the future challenges concerning people, businesses, and communities. Enjoy.

***

It was 11 January 2013 when Aaron Swartz, activist and founder of Reddit, was discovered hanged in his New York apartment. This marked the culmination of a life spent advocating for freedom of information rights and access to knowledge - in 2011 Swartz had been arrested for illegally downloading millions of scholarly articles from the JSTOR digital archive, which houses books and other academic content produced by 8,000 international institutions. Swartz was born in Chicago, but soon after the family settled in Highland Park, Illinois. His father owned a software development company, and Aaron began mastering programming as a child.

At the age of 14, he started collaborating with Tim Berners-Lee, a charismatic figure who is considered to be the father of the World Wide Web. Swartz became involved in the development of the RSS protocol and, still at a very young age, he participated in the design of the source code for Creative Commons licenses and their distribution. He then attended Stanford University, dropping out after a year to found the software company Infogami. Having co-founded the social network Reddit and sold it to Condé Nast, he then focused on the development of web platforms. At the same time, the tireless Swartz got busy and devoted himself to the very activism that had shaped him from a very young age.

Swartz is the creator of the "Guerrilla Open Access Manifesto" in which the keepers of knowledge, i.e. librarians, business managers, media personalities, academic and university figures, are urged to make it accessible. “Those with access to these resources, students, librarians, scientists - you have been given a privilege. You get to feed at this banquet of knowledge while the rest of the world is locked out.” This is what Swartz wrote in 2008.

During his imprisonment and after his death, a global debate broke out that eventually involved both prominent figures and ordinary citizens. A debate that took place across all ages. His fight for free access to information, which culminated in the downloading of millions of scholarly articles from JSTOR, exposed the friction between freedom of information and regulations on intellectual property. Swartz was instrumental in the development of RegTech - at the core of the use of technology for the management of regulations lies the need to create transparent and secure systems for managing data. Transparency and security for information management - a two-faced Janus that Swartz has always supported.

Aaron Swartz (Flickr)

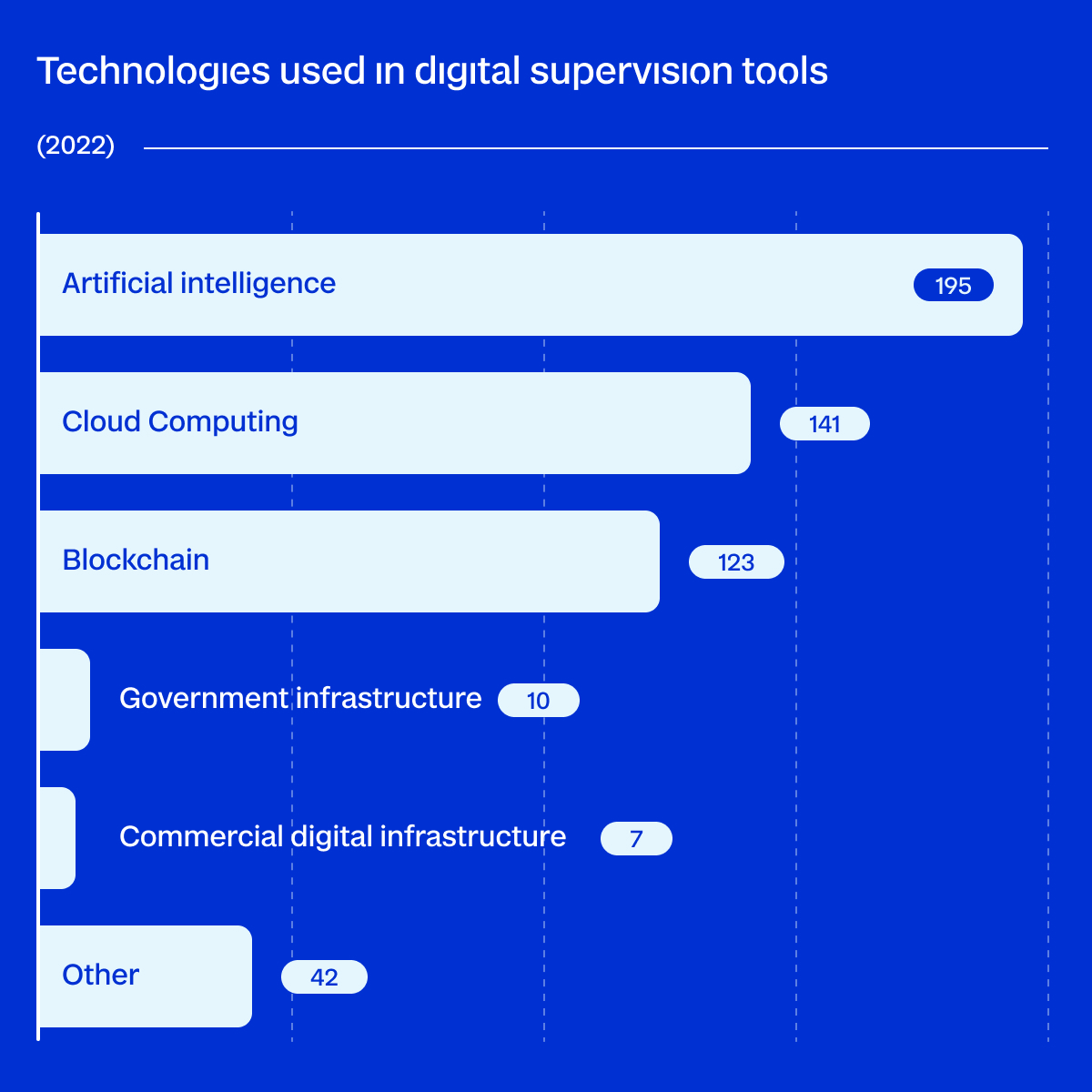

The declinations of RegTech in the world

RegTech is short for "regulatory technology" and it is a set of technologies designed to help companies meet regulatory and compliance requirements, as Thomson Reuters reports. RegTech solutions include several technologies useful to companies when managing regulatory risks and demonstrating compliance to supervisory authorities. Some of these technologies involve data analysis software, monitoring systems, and reporting platforms. An example of RegTech is the use of artificial intelligence algorithms to monitor customer data and detect possible illegal activities, such as money laundering. This enables companies to prevent breaches of regulations and avoid fines. What is pushing in the direction of ever greater use of innovative solutions are digital transformation and the new challenges brought about by the fintech industry. Ultimately, both of these will necessarily entail enhanced regulations.

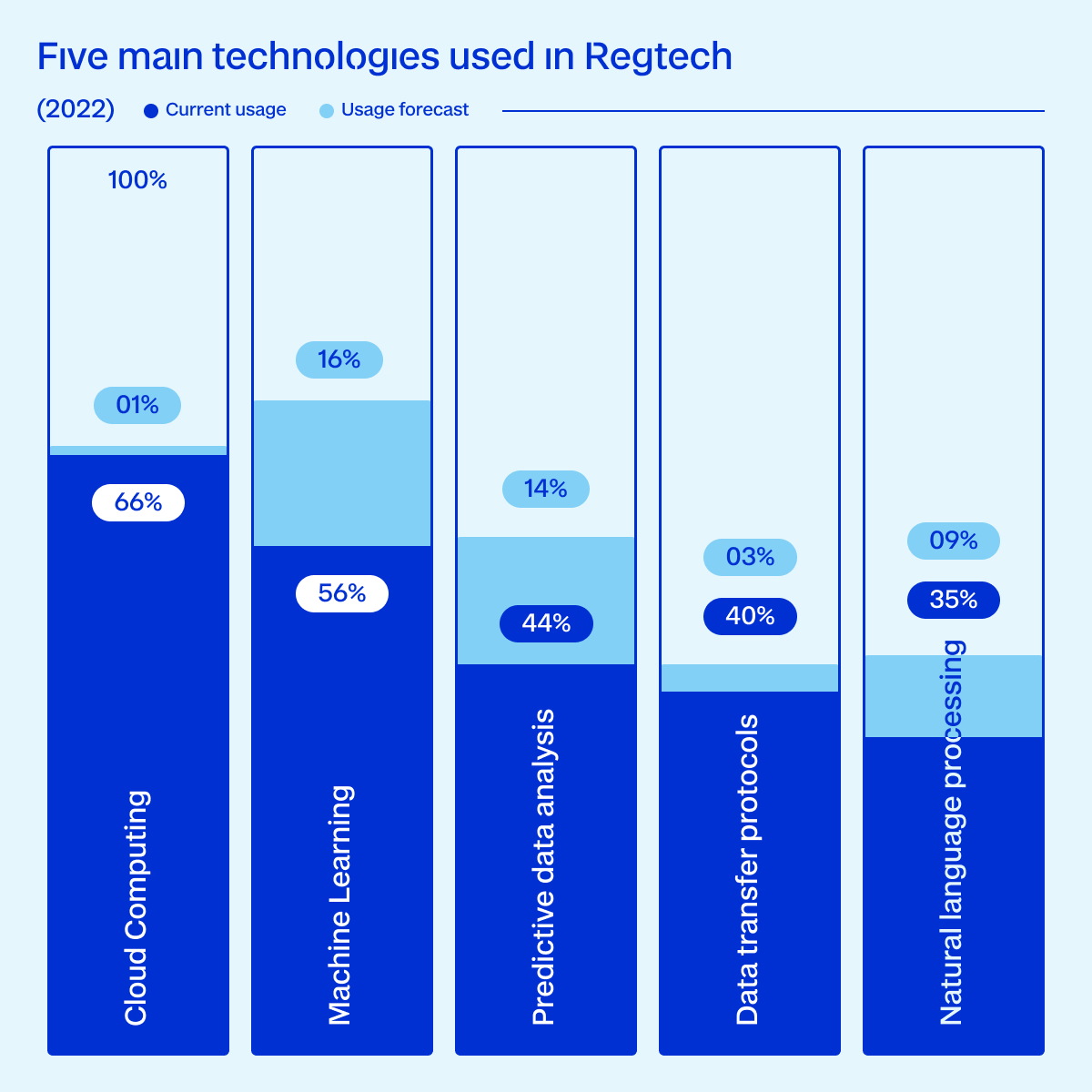

The use of traditional techniques is not enough to ensure high efficiency due to the large amount of information received from the subjects being monitored. For this reason, machine learning and AI are key technologies for the management of all aspects connected with regulation and are useful to enable a reduction of the workload that, until now, has been performed manually. Such solutions also result in a more efficient use of personnel, which can then be employed in other types of activities.

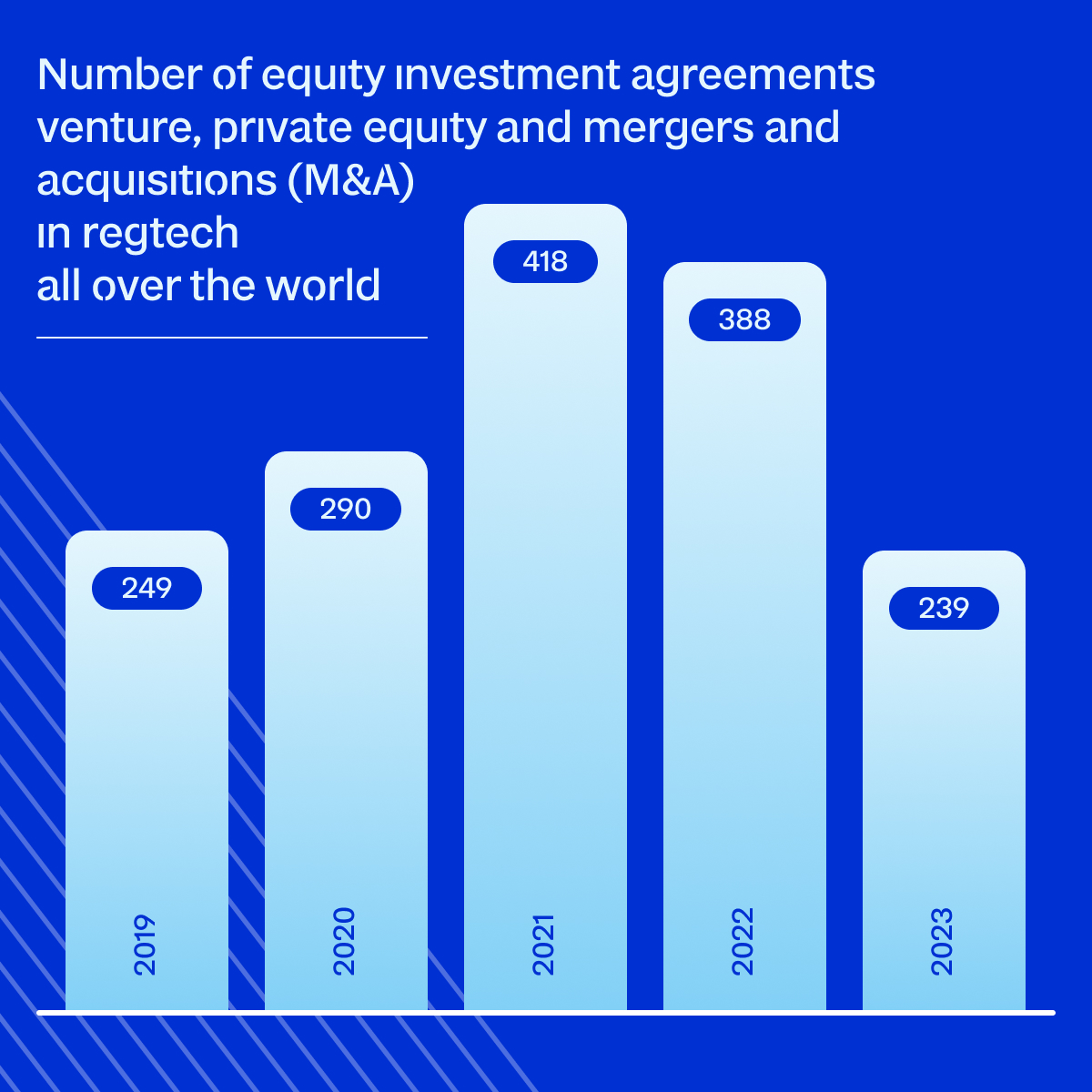

But beware. Last year, the total value and number of venture capital, private equity and M&A investments in the RegTech sector worldwide fell sharply, as did all investments related to fintech. It fell to $2.6 billion, the lowest ever figure in the period surveyed. The number of deals also dropped dramatically to 239. This is a surprising turnaround in investment activity, especially when considering that in the previous year, 2022, RegTech was indeed one of the few fintech segments where activity had increased. This is due to a period of severe stress for the markets with the conflicts in Ukraine and the Middle East, high interest rates and difficulties in exit transactions that have held back investments. Yet according to Juniper Research estimates, investments will increase by 124% between now and 2028, rising from $83 billion to $207 billion.

AI for compliance and monitoring

Competition pressure is fueling a widespread adoption of AI in the financial sector and is, in fact, rapidly changing its landscape. Artificial intelligence is enabling efficiency gains and cost savings, reshaping customer interfaces, improving forecast accuracy, and optimizing risk management and regulatory compliance.

According to a paper by the International Monetary Fund “Powering the Digital Economy: Opportunities and Risks of Artificial Intelligence”, AI can significantly improve compliance and monitoring mechanisms in the financial sector while providing a number of opportunities. AI can automate monitoring and regulatory compliance processes, thus reducing manual workloads and increasing efficiency in the detection of potential violations. AI-based systems can analyze large amounts of data in real time, enabling suspicious behaviors or anomalies that could be indicative of fraudulent or non-compliant activities to be identified. In addition, risk from human error is also reduced. This allows financial institutions to respond to potential threats in a timely manner. Indeed, by identifying patterns and trends in the data that might elude traditional methods, institutions are able to prevent illicit or non-compliant activities.

AI models are also being used by central banks who have started to implement them in their processes. Ultimately, these models allow them to improve their operations -and thus decisions - in a number of ways. For example, artificial intelligence enables improved economic forecasts through real-time analysis of a wide range of data, making projections more accurate and timely.

Another area where AI is proving to be crucial is in market sentiment analysis. Central banks monitor consumers' expectations regarding inflation by analyzing millions of daily social posts, thus gaining a more accurate picture of market dynamics. AI also supports the optimization of monetary and macroprudential policies with advanced data analysis enabling more informed and accurate decision-making capabilities. The efficiency of central banks' internal processes also benefits from AI, which monitors operations and optimizes resource allocation.

Privacy and biases, old new challenges

Ultimately, all this allows us to read between the lines of the exponential phase connected with data and their value (but also the underlying risk they contain). Moreover, we live in the data economy, this is the definition given by The Economist several years ago in a cover story that made history and has become a cult in the growing innovation sector. Data are the oil of the new millennium, and so the British magazine drew modern oil rigs with the logos of the hi-tech giants. Today, those logos should be updated with the leading players of the AI revolution. The swift emergence of AI and machine learning systems in the financial sector is in fact bound to have a major impact, requiring firm policy responses to ensure the integrity and security of the system. At the heart of the concerns there are several critical issues to consider - the first relates to the risk of biases embedded in the systems, meaning the biases inherent in the systems themselves.

Biases can result from erroneous or incomplete training data, leading to unfair discrimination and potential exclusion of entire segments of financial users. Regulatory bodies need to address the biases as a source of operational and reputational risk, encouraging financial institutions to develop appropriate mitigation strategies. Another crucial issue is the possibility to explain the decisions of these systems. Indeed, these models are often regarded as actual data flight recorders, and this makes it very difficult to assess the validity of their decisions and undermines confidence in their operations.

Addressing this problem calls for a fine balance between the complexity of the model and its explainability, an area that involves additional research efforts and regulatory interventions. In addition, the massive adoption of AI models could increase the risk of cyber threats, with new vulnerabilities that could be exploited through data manipulation or attacks targeting the model itself. These threats demand constant vigilance in order to detect and tackle possible breaches.

The issue of the privacy of data is equally critical, as concerns can arise regarding the protection of sensitive data and the possible disclosure of personal information through inference techniques. Robust tools are therefore being developed to protect sensitive data and update regulations to ensure adequate privacy standards. This can legitimize the use of AI in the financial system and preserve its stability. Addressing the challenges related to cyber threats, privacy of data, and the performance of the model is crucial, especially in periods, like the ones we are currently experiencing, which entail structural changes in the financial landscape. The game is a very complex one, with a multitude of players determined to make a difference. That is why today, more than in the past, the rules of the game become crucial.